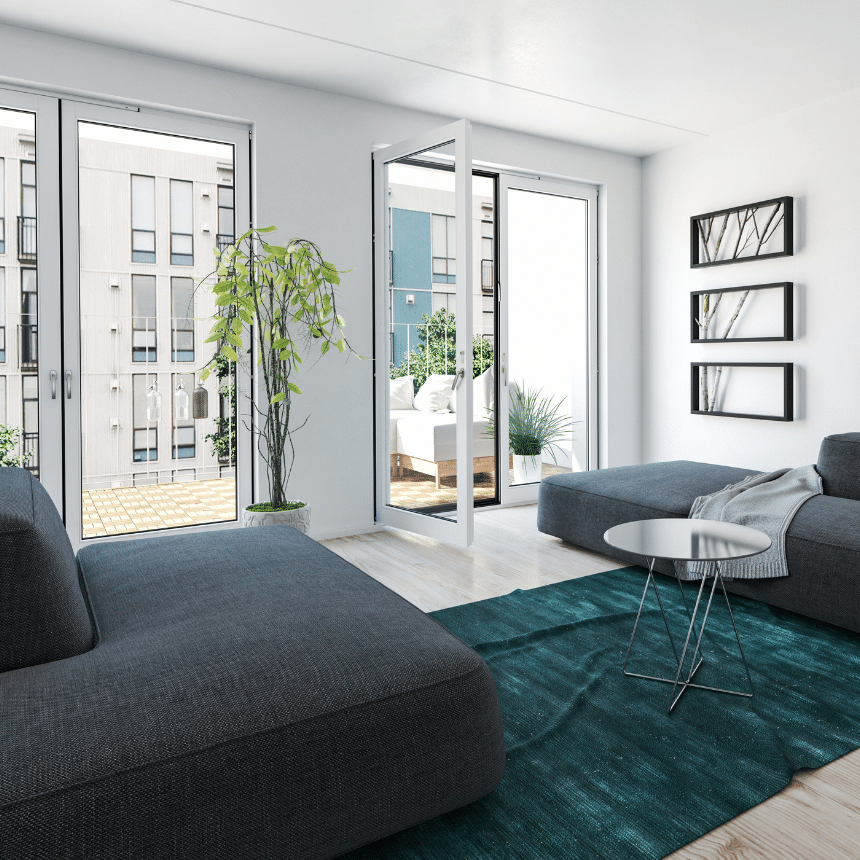

There are many types of home loans to choose from

GET THE MORTGAGE THAT FITS YOUR NEEDS

Adjustable Rate Mortgage (ARM)

An adjustable rate mortgage may be good for you if you plan to sell or refinance you home within the initial fixed-rate period, typically, seven years.

Highlights of Adjustable Rate Mortgage Loans:

- Lower initial monthly payments

- Borrowers who don’t plan on living in one place for long

- Fluctuating rates and payments

Jumbo Loans

A jumbo loan could be good for you if you have good credit but don’t have enough funds to bring the home loan amount under the conforming loan limit.

Highlights of Jumbo Loans:

- Ability to purchase more home

- Higher purchase limits

- Available for primary, second homes or investment properties

New Construction Loans

If you want the flexibility to customize your home from the ground up, a new construction loan with one-time closing could be good for you.

Highlights of New Construction Loans:

- One closing for lot acquisition and construction

- Primary residences only

- Variety of construction loan products

USDA Loans

If you are looking to purchase a home in a rural area, a USDA home could be right for you. This program helps eligible low-to-moderate-income families achieve homeownership by offering 100% financing.

Highlights of USDA Loans:

- $0 down payment

- Lower credit requirements

- Use of gift funds and grants as source of down payment

No Lender Cost Refinance

When you purchase today, you’re eligible for a no lender-cost refinance up to 2 years after purchasing.